There has been a consistent fall in battery prices over the past year and that can be attributed to increased production capacity & competition, high demand, technology upgradation and fall in prices of raw materials. The low cost of batteries have significant implications for sectors such as logistics and energy. Cheaper batteries can help developing countries to strengthen their decarbonisation efforts by relying more on renewable energy and EVs. The recent data from IEA mentions that demand from batteries for the first time crossed 1 TWh (Terawatt hour). Considering the demand will quadruple by 2030, the price decline trend will persist albeit with a much lower rate.

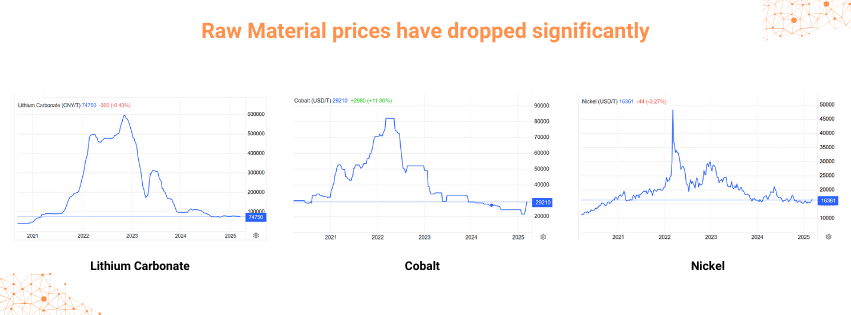

Cost of raw materials

Lithium-ion (Li-ion) EV battery prices have dropped significantly in recent years, largely due to the decline in the costs of key battery metals such as lithium, cobalt, and nickel. The average lithium carbonate price from its average 70,000 USD/t in 2020 trades now around 15,000 USD/t. Likewise, cobalt prices have come down from around USD 80,000/t to USD 30,000/t. The nickel has shown a similar trend too with a price drop of beyond 60% vs 2022. Reliable global supply chains, increased production of materials and refining capacity can keep the prices at these levels.

China’s dominance on battery production

China supplied around 75% of global battery demand in 2024 and it's expected to maintain such a high share in production. The core advantage China has is complete control over battery’s value chain- from procuring of raw materials, refining them, cell chemistry expertise, cell assembly capacity and final demand. The Chinese battery manufacturers often have access to raw materials well below the market price, making battery prices even more competitive. Although most of us heard the names of CATL and BYD, there are more than 50 major battery manufacturers in China making it a highly competitive market.

Japan and South Korea, apart from China, hold expertise in battery chemistry and production. Governments around the world are providing incentives for opening up battery manufacturing to shield themselves from global disruption. For example, the USA has been able to attract battery manufacturing into the country, resulting in 700 GWh additional capacity into construction apart from 200 GWh installed.

Future of battery chemistry

Chinese production dominance gives us good ideas about trends in battery chemistry. Traditionally, auto OEMs have always preferred NMC (lithium nickel manganese cobalt mixed oxide) chemistry due to its high energy density and ability to provide vehicles with longer range. The battery companies from Japan & South Korea in particular hold expertise in this battery chemistry. The Chinese battery manufacturers over the years with extensive R&D have made LFP (lithium iron phosphate) chemistry much more competitive. The critical advantage of LFP over NMC is cost- LFP batteries can be up to 25% cheaper than NMC. McKinsey predicts that around 2030, LFP will topple NMC technology and will have the majority of global share

Trends in EV Battery prices

When it comes to EV battery pack prices, achieving cost parity with internal combustion engine (ICE) vehicles has long been associated with reaching a target of $100/kWh. In China, battery pack prices (LFP) have already fallen below this threshold in certain cases. This has allowed several OEMs in mainland China to competitively price their EVs in smaller segments, making them comparable to ICE vehicles.

The cost of batteries in other regions is expected to be higher by more than 30% due to imports, higher cost of production and raw materials. Despite that, the critical hurdle of EV adoption may get resolved in coming years- battery cost.